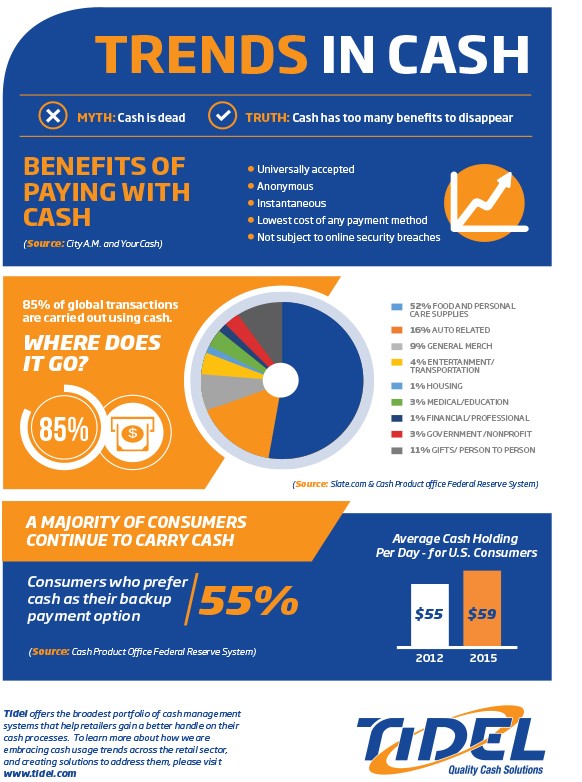

Plenty of resources around the globe mention the death of cash as a payment option. However, there are too many benefits in utilizing cash as a viable payment method for it to actually disappear. Figuring out the globe’s commitment to cash means following the data back to its source: the customer.

What are the benefits of cash? Is cash more likely to be used with certain merchants and transaction values? The research says yes. Cash is the most universally accepted, most autonomous form of payment method in the world today. There is also a safety aspect to cash that, in light of several security breaches in well-known retail establishments, has become very apparent to consumers who landed on the wrong side of a hacking event. Leveraging the right processes and systems, cash management can become as easy and attractive an option for you, the merchant, as it is for your customers.

The true question that comes into play is, where does this cash go? A majority of cash expenses for consumers are for food and personal care supplies. Next in line are auto related purchases and purchases between individuals. For this reason, 55% of consumers continue to carry cash with them. In fact, between 2012 and 2015, the average cash held amongst consumers has increased from $55 to $59. Cash is an easy alternative to plastic that’s flexible in small amounts. Cash is far simpler for a customer to handle. Given these trends, merchants would be well-advised to optimize their cash management processes, because cash isn’t going anywhere.

To learn more about how Tidel offers a variety of cash management solutions for a cash-trending world, visit tidel.com/markets/, and click on the graphic below for more details.